A new way to evaluate VC investments...

(and your company's worth)

This website was created as a web-based companion to the second edition of Venture Capital and the Finance of Innovation. Inside, authors Metrick and Yasuda present NEW web-based tools that allows easy visualization and valuations of multiple term sheets in a startup.

Click for overview...

The VCV Tools:

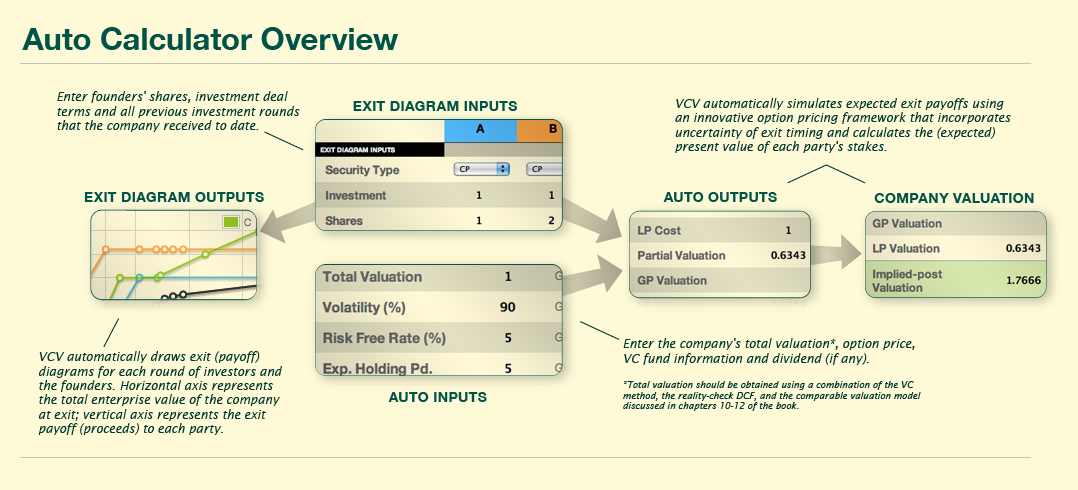

AUTO Calculator & Exit Diagrams

A truly powerful tool for analyzing the impacts of term sheet design on the value of one's stake in a startup.

Users enter term sheet information and other relevant inputs, and Auto calculates the division of the company value between founders and investors, between early-stage and late-stage investors, and between GP and LP of the VC fund backing the investment round.

Meant to be used in combination with: (i) the VC method, discussed in Chapter 10 of the book; (ii) the reality-check DCF model, designed to evaluate the total value of the startup at exit and discussed in Chapter 11 of the book; and (iii) the comparable (relative) valuation model, an alternative to the DCF model, used to evaluate the total value of the startup at exit and discussed in Chapter 12 of the book.

NEW to second edition!

This tool translates term sheet information into fully specified individual payoff schedules for current round investors, founders, and earlier round investors. Great for quickly visualizing how a change in investment terms (e.g., changing the number of shares, excess liquidation preference, or adding a participation feature) affects payoffs to all related parties.

FLEX Calculator

Lets users manually enter exit equation information, GP%, and option-pricing inputs and calculates partial valuation and LP valuation of the deal.

The Flex calculator is great for acquiring deeper understanding of the workings of the VCV model, and also for analyzing a complex investment situation that the preprogrammed functions in AUTO Calculator cannot handle.

Option Calculators

European Call Calculator

Lets users enter option-pricing inputs and calculates the value of a European call option using the Black-Scholes formula, as discussed in Chapter 13 of the book.

Random-expiration (European) Call Calculator

Implements the random-expiration version of the Black-Scholes European call formula, as discussed in Chapter 13 of the book.

More on the book:

"This book is an excellent bridge between finance theory and venture capital practice. Metrick presents cutting-edge financial tools, creatively apllied to venture capital and R&D investing. It is destined to become the required reading for all students and practitioners in the field."

-Paul A. Gompers, Eugene Holman Professor of Business Administration & Director of Research, Harvard Business School

"This book is an excellent bridge between finance theory and venture capital practice. Metrick presents cutting-edge financial tools, creatively apllied to venture capital and R&D investing. It is destined to become the required reading for all students and practitioners in the field."

-Paul A. Gompers, Eugene Holman Professor of Business Administration & Director of Research, Harvard Business School

"Despite the increasing importance of the venture capital industry, until now there was no reference that could provide practitioners with a specialized grounding in finance. With clear explanations and practical models, Metrick's book can fill this gap. I enthusiastically recommend this book to all venture capitalists."

-Ted Schlein, Partner, Kleiner Perkins Caufield & Byers

"Despite the increasing importance of the venture capital industry, until now there was no reference that could provide practitioners with a specialized grounding in finance. With clear explanations and practical models, Metrick's book can fill this gap. I enthusiastically recommend this book to all venture capitalists."

-Ted Schlein, Partner, Kleiner Perkins Caufield & Byers

"Investors in young, fast-growing companies have a new way to calculate their value without regard to the prices of other companies' stocks. This is an important advance, because most other appraisal methods for start-ups are based on relative valuation, which -- as we saw at the top of the Internet bubble -- grossly overvalues a new company when comparable companies in the same industry are also overvalued."

-Mark Hulbert, The New York Times

"Investors in young, fast-growing companies have a new way to calculate their value without regard to the prices of other companies' stocks. This is an important advance, because most other appraisal methods for start-ups are based on relative valuation, which -- as we saw at the top of the Internet bubble -- grossly overvalues a new company when comparable companies in the same industry are also overvalued."

-Mark Hulbert, The New York Times